For suicide -

In the states, being suicidal gets you institutionalized in a place that will not help. These places are straight out of One Flew Out of the Coockoos Nest. There is no regulation. There is no oversight.

Imagine wanting to die and being punished for it. There’s a reason suicide rates increase after inpatient hospitalization.

The places I’ve seen in Europe actually seem to try to help their patients. I’ve seen TikTok videos from people staying inpatient in places in the UK - they’re allowed to have their phones there.

Getting help with ideation is impossible, because if you cross that line and admit to much you get treated like a fucking criminal.

The government owns your body and gets upset when you try to damage their property.

It’s the only reason the system is set up how it is.

Millennials are killing the living industry.

Cant afford health insurance, much less insurance, co pay, second opinions, more co pay, appointments spread over months so max deductible isnt hit. Its a fuckin joke and if i have something wrong with me i’ll just die from it.

Millenials […] early adult.

😂

Seeing 25-44 being referred to as early adult was the first thing to put a smile on my face since I turned 40

I guess so many of us aren’t having kids and can’t afford houses that we come across like young adults from earlier generations!

oh no, not the volk

won’t someone please think of the volk? they’re dying at a rate!

the more of us are in an early grave, the fewer of us to continue the relentless march into fascism so I’m all for it

Your solution to the rise in fascism is to just… die?

There are probably other solutions. Don’t give up.

Historically speaking, the solution to fascism is lots and lots of dead fascists.

This is the way.

well duh.

When it becomes impossible to afford to A. have a family B. hell even be in a relationship C. afford a home D. rent for the rest of your life and then struggle to pay rent or meet the annual rent increases and E. wages continue to stagnate there’s really not much of a point in living.

Add all this to the US healthcare system where if you get sick you essentially have to “hope for the best” or if it’s something incredibly serious you then become dependent on the kindness of strangers via a GoFundMe then yeah…it’s grim.

You could safe it by turning the title into “American Billionaires are Dying at an Alarming Rate”

I think you mean “aren’t” dying at a high enough rate?

I meant that would fix the situation but I didn’t write it well

I like how seemingly no one here is reading the article because of the paywall, which no millennials (including me) are going to pay to get past, which is emblematic of why no one is going to pay attention to the findings of these (at a quick look) millennial-age-bracket-looking researchers instead of raging into Facebook algos or whatever most folks do. There are so many layers of irony.

The information pipe to steer us outa this is so busted. It’s unreal.

And yes, I know I can find the archive link…

Here is the paper linked in the article. Feel free to share it on Facebook

https://www.doi.org/10.1001/jamahealthforum.2025.1118

Introduction

Mortality rates decreased more slowly in the US than in other high-income countries (HICs) between 1980 and 2019,1 resulting in growing numbers of excess US deaths compared with other HICs.1-4 We assessed trends in excess US deaths before (1980-2019), during (2020-2022), and after (2023) the acute phase of the COVID-19 pandemic. Methods

This cross-sectional study was deemed exempt from review and informed consent by the Boston University Institutional Review Board because no human participants were included. We followed the STROBE reporting guideline.

We obtained all-cause mortality data for the US and 21 other HICs from the Human Mortality Database from January 1980 to December 2023.5 For each year, we computed age-specific mortality rates for the US and the population-weighted average of other HICs. We then calculated the number of US deaths that would have been expected each year had the US population experienced the age-specific mortality rates of other HICs. We computed ratios of observed-to-expected US deaths. We then computed numbers of excess deaths attributable to the US mortality disadvantage by taking the difference between observed and expected US deaths. We stratified by age. Finally, we fit a linear regression model to assess whether the number of excess US deaths in 2023 differed from the 2014-2019 prepandemic trend (eMethods in Supplement 1). Analyses were conducted with Stata/MP, version 18.0 (StataCorp LLC), and R, version 4.42 (R Project for Statistical Computing). Results

Our analysis encompassed 107 586 398 deaths in the US and 230 208 265 deaths in other HICs from 1980 to 2023. We estimate that 14 735 913 excess deaths occurred in the US in this period compared with other HICs. US mortality rose rapidly in 2020 and 2021 during the pandemic, then declined in 2022 and 2023. The pandemic-era mortality surge was less pronounced in other HICs (Figure, A). Figure. Mortality Rates, Mortality Rate Ratios, and Excess US Deaths Attributable to the US Mortality Disadvantage Relative to Other High-Income Countries (HICs) Mortality Rates, Mortality Rate Ratios, and Excess US Deaths Attributable to the US Mortality Disadvantage Relative to Other High-Income Countries (HICs) (opens in new tab)

A, Trends in US mortality rates, mortality rates of other HICs, and average mortality rates in other HICs standardized to the US age distribution in each year (1980-2023). B, Age-specific mortality rate ratios comparing US mortality rates to the average of other HICs (2014-2023). C, Excess deaths attributable to the US mortality disadvantage (1980-2023). D, Linear extrapolation of the prepandemic trend in excess deaths over the period from 2020 to 2023. B and D start in 2014 to enable visualization of trends immediately before, during, and after the acute phase of the COVID-19 pandemic. The comparison set of HICs included Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Iceland, Ireland, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. In panel D, the solid orange line shows the linear regression fit for 2014-2019; the dotted orange line extrapolates this trend through 2020-2023; the shaded area indicates 95% CIs; and the vertical black lines indicate deviations of excess US deaths from what would be expected based on the prepandemic trend.

Relative differences between the US and other HICs widened before and during the pandemic, particularly among younger adults, before contracting in 2022 and 2023. Age-standardized mortality rate ratios comparing the US with the average of other HICs were 1.20 in 2010, 1.28 in 2019, 1.46 in 2021, and 1.30 in 2023 (Table). In 2023, mortality among US adults aged 25-44 years was 2.6 times higher than in other HICs (Figure, B). Table. Observed Deaths, Expected Deaths, Mortality Rate Ratios, and Excess Deaths Attributable to the US Mortality Disadvantage, 1980-2023 Observed Deaths, Expected Deaths, Mortality Rate Ratios, and Excess Deaths Attributable to the US Mortality Disadvantage, 1980-2023 (opens in new tab) Year All ages Children and adults (aged 0-64 y) Older adults (aged ≥65 y) No. of US deaths Mortality rate ratio No. of excess US deaths (% of observed) No. of US deaths Mortality rate ratio No. of excess US deaths (% of observed) No. of US deaths Mortality rate ratio No. of excess US deaths (% of observed) Observed Expected Observed Expected Observed Expected 1980 1 989 837 2 031 945 0.98 −42 109 (−2.1) 647 614 522 254 1.24 125 360 (19.4) 1 342 222 1 509 691 0.89 −167 469 (−12.5) 1990 2 148 467 2 058 809 1.04 89 658 (4.2) 606 088 461 031 1.31 145 057 (23.9) 1 542 379 1 597 778 0.97 −55 399 (−3.6) 2000 2 403 399 2 048 411 1.17 354 987 (14.8) 603 345 447 098 1.35 156 247 (25.9) 1 800 054 1 601 313 1.12 198 741 (11.0) 2010 2 468 426 2 059 256 1.20 409 170 (16.6) 670 064 456 743 1.47 213 322 (31.8) 1 798 362 1 602 513 1.12 195 849 (10.9) 2019 2 854 826 2 223 579 1.28 631 247 (22.1) 737 398 419 815 1.76 317 583 (43.1) 2 117 428 1 803 764 1.17 313 664 (14.8) 2020 3 383 749 2 375 380 1.42 1 008 369 (29.8) 874 271 436 569 2.00 437 702 (50.1) 2 509 479 1 938 812 1.29 570 667 (22.7) 2021 3 464 260 2 365 452 1.46 1 098 808 (31.7) 969 489 441 582 2.20 527 908 (54.5) 2 494 771 1 923 871 1.30 570 900 (22.9) 2022 3 279 915 2 459 519 1.33 820 396 (25.0) 853 052 432 049 1.97 421 003 (49.4) 2 426 863 2 027 470 1.20 399 393 (16.5) 2023 3 081 628 2 376 297 1.30 705 331 (22.9) 777 813 419 866 1.85 357 947 (46.0) 2 303 815 1 956 431 1.18 347 384 (15.1)

Excess deaths attributable to the US mortality disadvantage peaked at 1 008 369 in 2020 and 1 098 808 in 2021, then declined to 820 396 in 2022 and 705 331 in 2023. These numbers followed 4 decades of rising excess deaths, reaching 631 247 in 2019 (Figure, C and Table). In 2023, excess US deaths accounted for 22.9% of all deaths and 46.0% of deaths among US residents younger than 65 years (Table).

Regression analysis demonstrated that the rising trend in excess US deaths before 2020 continued during the pandemic. Excess deaths in 2023, although lower than in 2020 to 2022, were higher than in 2019 and consistent with the slope established from 2014 to 2019 (Figure, D). Discussion

Between 1980 and 2023, the total number of excess US deaths reached an estimated 14.7 million.1 Although excess deaths per year peaked in 2021, there were still more than 1.5 million during 2022 to 2023. In 2023, excess death rates remained substantially higher than prepandemic rates. The rising trend from 1980 to 2019 appears to have continued during and after the pandemic, likely reflecting prepandemic causes of death, including drug overdose, firearm injury, and cardiometabolic disease.6 These deaths highlight the continued consequences of US health system inadequacies, economic inequality, and social and political determinants of health.1-3,5

Study limitations include potential sensitivity to choice of comparison countries, use of provisional data for some countries in 2023, and lack of stratification to investigate differences by sex, race and ethnicity, and socioeconomic status. Our results suggest that policy solutions may be found in the experiences of other HICs. Future research is needed to identify the specific causes of the widening US mortality disadvantage and opportunities for intervention.

This one was actually easy. If you use Firefox, click reader view, and the entire article is available. It’s rare, but sometimes it works.

- I’m scrabbling and doing everything to stay alive for my parents so that they don’t worry. When they pass, fuck it, I’ll probably help the statistic along.

I feel you. If not for the immediate family, the aging dog, and maybe one or two friends that I have to be the one to put effort into maintaining any contact, no one would miss me or care. I don’t want to hurt them. My sibling is not directly trying to actively ‘go in’ (the community/activity word for dying in the course of the activity) in their hobby, but it’s a hobby with a death rate of about 1/20 per year of participants. In all likelihood, since I’m caring for one of my parents, I’ll get to see all of them pass on within a short period and then make my decisions.

Quite similar to me. I just barely care enough about my parents. Also, thanks to the financial situation we’re in … they’ve decided to move into my house and not move out.

Like I earn decent change (not enough for two mortgages, mind you) but I’m already in my forties and I’m waiting for them to pass. I’m barely mentally holding onto living this day-to-day life while not freaking out on them on the regular.

Does it have something to do with wealth inequality and quality of life being so inextricable from personal wealth? That would be my guess, but I don’t know for sure bc paywall… Oh well.

I’m sure some of it is wealth distribution and some is access to healthcare. Culture also has an effect of course. But from the chart I saw in one these comments shows 22-44 year olds being 2.5 times more likely to die than other high income countries. That sounds absurd. (As in bad, not unbelievable)

Definitely but quality of life is tied to healthcare, and in the U.S. access to healthcare is sadly tied to wealth.

Younger millennial, single, small one bedroom apartment that isn’t fancy, 2 cats, no kids. I didn’t get to go to college after high school, my parents weren’t about to help me, either financially or practically, and I just couldn’t figure out the paperwork/admin nor could I have afforded it myself or gotten loans without a cosigner. I eventually got an ok paying job that required a certification. I work anywhere from 40-70 hours a week and I can still barely afford to pay my bills. I’ve gone over a month without buying food and lived off whatever free food I can grab at work. I’m slowly working my way through a college degree that I’m unenthusiastic about, but I got denied financial aid because I have to make enough to live and cover my rent like an adult and FASFA looks at my annual income and thinks that since I don’t own a house or have kids I have no living expenses and that I can easily afford 30k in tuition every year, so I’ve gotten zero grants or scholarships and at this point I’m only trying to finish my degree so I have something to show besides my stupid loans. I’ve been putting away a portion of my income in a matched 401k for the past 10 years but lot of good that did me, it’s lost far more money than it’s ever gained, and it’s expected to give me a mind blowing $15 a month when I retire if I continue at the current rate. My retirement plan is suicide, but more and more I don’t see why I’d wait for retirement age. I have no time or money for hobbies and there’s nothing in my life that brings me joy besides my cats. I think once they’re gone I’ll go with them.

I’m with the other commenters, baffled about your 401k comments. I changed jobs in 2017 so the 401k I had with that company is a good case study. It’s doubled its balance without a single contribution (obviously, since I left that company).

How did your 401k lose more than gained. That would basically be fraud. Just doesn’t work that way. And you left out that you are technically disabled (adhd). I’m not saying shit ain’t fucked up, but this story seems an exaggeration.

Im also curious because over the past 10 years there have been several periods with really high returns.

I don’t know about the other stuff, but I had a job from late 2021 to early-mid 2023. By the time I left the job, the net contributions over about 18 months were $9,992.78, and the balance was $10,340.83.

From the 2nd through the 11th month, the balance was literally less than net contributions.

18 months is very short for a 401k. They usually say to start looking to move the money out of the volatile market and in to stable investments 5 to 10 years before you need it so that you can avoid short term down markets and maybe catch some high spikes.

How did it lose more than it gained? The loss in interest in investment plus the yearly management fee from the company my employer chose to manage the stupid thing is more than the gains during the good years? I’m no investment expert, all I know is that anytime it gains money it then loses all that shortly after. I’d be better off putting the money in a savings account except at least this way I get employer match. And sure I have ADHD, but it’s not like I’m disabled and unable to work, I’m still working and going to school. You want to tell me that I shouldn’t be able to support myself working over 40 hours a week (and I am not working a minimum wage or “low skilled” job)

If they’ll let you take it and put it in your own 401k I’d suggest doing that. Choose a low-fee brokerage that doesn’t fuck with your investments to incur fees. That’s how they make their money, by taking yours. Choose index funds and let it ride, keep adding when you can, don’t mess with it.

Can I be next?

Aw, man, I hate seeing your name, but always love seeing that it’s you. I wish I could make it better for you.

Sorry but I’m next in line

Let’s make it a 2-for-1.

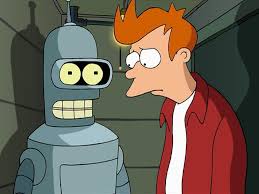

That’s not a suicide booth, that’s Bender’s apartment.

I blame the boomers for being way too selfish. They’re ruining it for everyone else

i told my mother (boomer generation) that now that she’s 70 she should think about planting a tree she will never see grow.

she looked at me like i told her to go fuck herself and told me that was dumb.

the boomer problem is an everyone problem.

70 could live 10-20 more years. You can see a tree grow in several years. If was kind of a duck comment

Yeah, I don’t know mom and maybe she deserves it or it makes more sense in context, but to me that comment sounds like “you’re old and you’re going to die soon.”

The saying, “Society grows great when old men plant trees under whose shade they know they’ll never sit,” is pretty well known. Unless you’re (mom) looking to pick a fight over some ‘bitch, that’s a whole new sentence’ interpretative inference, SOP’s statement can’t be taken as ““you’re old and you’re going to die soon.””

Not all boomers.

Also, I don’t see all that much difference in boomer attitudes than some of the ones I see/saw in the Silent Generation and the “Greatest” Generation when it comes to at least a subset of them being very conservative and selfish in older age.

No, but enough of them to remove most of the ladder rungs for anyone after the.

Ever since I can remember, I’d hear those from the boomer generation say similar things about older generations, both in TV/movies, and IRL.

What will be different about Gen Y once they become the wealthiest generation in history? Is there some latent difference there which will be unleashed that will reverse the extreme wealth inequality that has been ramping up throughout the decades?

Time will tell, I guess.

Wasn’t there just an article about Gen X folks being a significant part of the reason trump won the vote? I don’t think we’re heading anywhere good just by generation trends.

What will be different about Gen Y once they become the wealthiest generation in history?

😂

Not sure if you are laughing because you expect it to be no different than prior generations or if you didn’t know they are set to become the richest generation in history?

Well, they can’t take it with them.

The Great Wealth Transfer is under way, and I’ve read that Gen Y is poised to become the wealthiest generation in history. Will they be any different than the boomers or the Silent Generation or the Greatest Generation? (I’m Gen X; we are used to being ignored and sidelined at nearly every turn, lol) What will they do with all that wealth? Do they, by dint of being born between two arbitrary years, have some magical property other generations don’t?

https://en.wikipedia.org/wiki/Great_Wealth_Transfer

https://edition.cnn.com/2024/03/01/economy/millennials-richest-generation-in-history/index.html

This is such bullshit. Many will never see this wealth transfer, either because they have no intergenerational wealth in their family, or because the real enemy is looking to prevent it from passing down. Many states have laws that’ll make mortgage rates and taxes increase when that wealth gets passed down, causing many people to sell that capital for short term income, further driving the younger generations into fiefdom for the wealthy feudal lords. It’s a self reinforcing cycle that makes a middle class statistically impossible. No bourgeoisie; only nobility.

There is no winning at this late stage capitalism, because we no longer live in a system where people can save, aquire wealth, and retire. One bad day is all it takes for almost anyone to lose everything, and those bad days are engineered to be so frequent that it’s all but guaranteed eventually. The only wealth transfer is into the pockets of those who already have extreme wealth, and you will not be one of those people.

The article makes points about the distribution and that Gen Y, along with being the wealthiest generation in history, will likely have even more inequality than prior generations.

I guess we’ll see if Gen Y does something different than any generation prior.

I don’t feel like we need to spend much effort predicting how the “wealthiest generation of history” with relatively unprecedented amounts of wealth inequality is going to play out. Rich assholes will feel entitles to become even richer with only extremely weak societal checks to keep them from running amuck. I expect the leadership of gen y to be - at a baseline - even more violent and exploitative than the current leadership meta

They didn’t even read their own links. From the Wikipedia page they linked (emphasis mine) :

Inheritance has become more common among households, with 60% of surveyed households in 2022 having received, expecting to receive, or planning to leave inheritances. Wealthy individuals make up 1.5% of all households but constitute 42% of the expected transfers through 2045, approximately $35.8 trillion. The wealthiest 10% of households will give and receive the vast majority of the wealth, with the top 1% holding about as much wealth as the bottom 90%

First off, the background is based on surveys, not hard data of any type. Expecting an inheritance doesn’t mean being guaranteed to receive one. Where’s the actual data? Second, it’s painfully clear that this “great wealth transfer” is going to miss the vast majority of us. How OP could’ve read this and interpreted it to mean that Gen Y/Millennials are somehow, as a cohort, supposed to become super wealthy? I have no idea.

Then their CNN link, from its very first paragraph (again, emphasis mine) :

However, over the next twenty years, Millennials are poised to inherit some $90 trillion of assets and become the richest generation in history – but only the ones who already come from affluent families, potentially deepening wealth inequality further.

It’s just rich people doing rich people things. This inter-generational phrasing is propaganda to distract us from the real opposition, the ultra wealthy, who are holding all of us down regardless of our age.

There is no war but class war.

I’m sure they did read the content in the links. The point they are making is exactly your final line. There’s this refrain of “Boomers are ruining everything!” but the reality is it’s a small number of people with a lot of money using that money to do what they please at everyone else’s expense.

When the last “boomer” dies, the problem will remain. If we collectively fail to address it, then it’s just going to change up to “Dang GenYs ruining everything!”

It sounds like the US is just a dangerous place to live in a variety of ways, it’s interesting that traffic fatalities are one of the reasons behind their high rate of premature death.

Still others highlight America’s permissive gun laws

While I don’t have numbers broken out by age range, over half of all gun deaths in America each year are suicides. Source: https://gunviolencearchive.org/

Instead of banning guns and calling it done, maybe we should help those people to want to be alive. That way, so-called permissive gun laws simply wouldn’t be relevant.